Forex question

When is the best time to trade currencies?

When is the best time to trade currencies?

Kathy Lien, GFT

Kathy Lien, GFT

When it comes to trading, everyone is trying to look for an “edge” but of course it is not easy to find. An edge can come in any form and is usually a small change that can make a difference. Many people, particularly new traders, do not realize that you can gain an edge in currencies by simply trading only during specific times of the day. A common mistake that traders make is to try to apply the same strategy across different currency pairs and time frames. However, an even bigger mistake is to try to look for trades based upon a specific strategy during all times of the day. Unlike other markets, in forex, a trader can look for his or her setup and place a trade at 7 in the morning or 7 in the evening. The problem is that a strategy that works at 7am may not work as well at 7pm and vice versa. This is particularly true for short-term traders who have no interest in holding a position overnight.

For example, let us assume that we are using a breakout strategy. In order for a breakout to occur, there needs to be a catalyst. In order for there to be a continuation, there needs to be momentum. Therefore, the best time of the day to look for breakout opportunities and to avoid a fake out is around major economic releases when there are a lot of participants in the market. More specifically, breakout strategies work best around European and U.S. economic releases.

Range traders on the other hand need to avoid trading around economic releases and any time of day where there can be significant volatility. When there is breaking news, the ranges tend to be broken. Therefore, the best time of day to trade for range traders is when there is no economic data being released anytime soon and when there are fewer participants in the market.

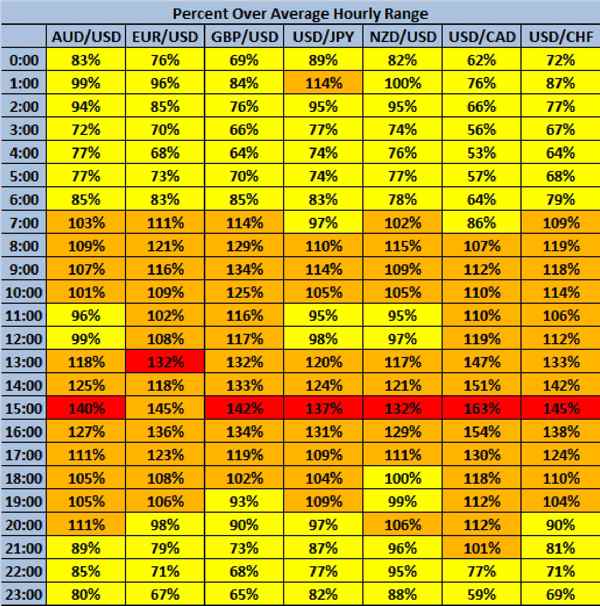

We can even drill this down to specific hours. In the following table, we have analysed a year’s worth of hourly trading data for the major currency pairs and created a heat map based upon whether the range during a specific hour is above or below the average. Yellow represents below average, orange represents above average volatility during that hour and red represents the hour where volatility is the highest (times are in GMT).

Based upon our study, the best times for breakout or momentum traders to trade is between 13:00 and 17:00 GMT when both European and U.S. traders are in the market. This makes perfect sense since close to 60 percent of global forex turnover happens during the London and U.S trading session. The best time for range traders to trade is between 21:00 and 6:00 GMT which is when there tends to be little event risk and only Asian traders in the market.

Believe it or not, you can gain a valuable edge by simply trading only during the times of day that is conducive to the strategy.

By Kathy Lien, Director of Currency Research at GFT

Other articles in this week's newsletter

Cheap stocks now to time the recovery

Central Bank selling and the gold price

When is the best time to trade currencies?

Transition to Retirement Strategy - and adding the maximum to super

Top 10 CFD stocks for the week

» Subscribe to TheBull's free weekly newsletter to receive all the latest news and views from Australia's leading journalists. Ask us a question

TheBull.Asia newsletter -

FREE!RESOURCES & OFFERS

Free Investing Newsletter on Asian and Australian markets. Be ahead of the curve with TheBull.

Read moreJoin CommSec now and get $600 free brokerage.

Find out more